If you’re ready to start a new company in Arizona, you may be a little confused about the legal process. No one loves digging through red tape or filing papers. However, in order to get your company off to a good start, you must follow all of the state’s requirements.

Fortunately, establishing an Arizona LLC is simple and inexpensive. If you follow the steps in the correct order, you should be able to shape your new LLC without too much difficulty.

You will start your new company easily and comfortably if you understand Arizona LLC formation criteria.

This detailed toolkit will walk you through the steps required to create a new LLC in Arizona. We’ll walk you through every step of the LLC forming process here. You will successfully complete each requirement with our assistance before moving on to the next level.

We’ll also talk about how the right LLC partner will help you navigate the business creation process and add value to your business once it’s up and running.

After you’ve established your new Arizona LLC, you’ll be able to concentrate on what really matters: growing your company. This guide simplifies the creation of an Arizona LLC so that you can begin servicing customers as soon as possible.

What is an LLC?

Simply placed, a limited liability company is a single entity that owns and operates a corporation. This may be you as the sole owner or a partnership with other owners, but the owners have complete control over the company.

This flexibility is ideal for startups because it offers the necessary flexibility while still lowering the risks associated with other business models such as sole proprietorships.

LLCs vs Other Business Models

Many company owners choose to structure their companies as LLCs for a number of purposes, the most important of which is to reduce personal liability when launching a new venture. Aside from liability insurance, having an LLC will significantly reduce your paperwork, increase the reputation of your company, and provide tax benefits.

For small companies, forming an LLC is the most attractive choice because it provides more security for personal assets than forming a sole proprietorship. Furthermore, as opposed to companies, LLCs are simpler to form and run.

The Benefits of Starting an LLC in Arizona

Since they provide limited liability insurance, organizational flexibility, and favourable taxes, LLCs are one of the most common business structures in Arizona.

Arizona LLC allows business owners to:

- Personal properties should be shielded from civil responsibility and company debts.

- Utilize versatile management and ownership structures that are customized to the essence of their company and its owners.

- Avoid the need for expensive organizational maintenance and monitoring.

- Rather than paying taxes on business income and individual wages, only pay personal taxes.

- Increase their chances of finding investors and lenders by legitimizing their company.

LLC Requirements Arizona required to start an LLC

LLC Registration

LLCs must file Articles of Organization with the Arizona Corporate Commission, along with a cover sheet, member/manager-structure attachment, Statutory Agent Acceptance form, and the appropriate filing fee. The following details must be included in the Articles of Organization:

- Name of the LLC

- Name, address, and completed approval form of the registered agent/statutory agent, M002.

- Address for business

- Indicate management style, such as member-managed or manager-managed

- Name, address, and signature of the organizer

- All forms must be submitted along with the necessary filing fee. Following approval by the Corporation Commission of Arizona, a letter will be sent to the statutory agent with instructions for publishing the notice of LLC creation. Following acceptance, the notice must be released.

Registration Timeline

Unfortunately, there is no next-day or same-day processing in Arizona. Documents are usually processed within six to nine working days. If you prefer expedited facilities, the turnaround time is shortened to three to five working days with an extra fee.

Requirements for Naming

The criteria for naming an LLC can be perplexing. However, the simplest way to ensure that your LLC name is accepted is to ensure that it is distinct from other LLCs and contains unique words expected of LLCs. Before filing your LLC creation papers, you may have a preferred name reviewed for availability.

Requirements for Formation

A registrant must first file their Articles of Organization with the corporation commission in order for an Arizona LLC formation.

All applications must include a $50 filing fee as well as the following documents: a cover sheet, a member/manager-structure insert, and the Statutory Agent Acceptance form.

Fees are subject to change; for the most up-to-date information, contact the Corporation Commission of Arizona.

Following that, it is strongly recommended that an LLC with more than one member have a limited liability company operating agreement among its members.

This operating agreement includes the terms agreed to by the LLC’s members and regulates important items such as each member’s positions, voting rights, who manages the LLC, how members are admitted or excluded, dissolution of the LLC, and procedures for amending the operating agreement itself.

Please keep in mind that LLCs delivering a particular professional service are required by state law to contact the relevant licensing boards.

How To Start an LLC in Arizona

Here are some suggestions to help you gather the information you’ll need to start the registration process of your LLC formation.

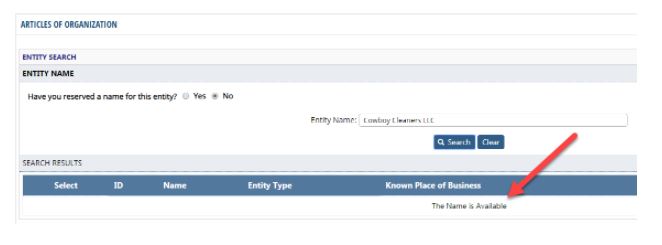

1. Choose a name for your business

The first move is to come up with a distinctive name for your Arizona LLC. Arizona, like other states, mandates that the LLCs be named differently from other successful companies that have registered with the Arizona Corporation Commission. Examine Arizona’s business name database to see if your proposed business name is available.

An Arizona LLC name must end with one of the following terms or abbreviations:

- Limited Liability Company

- Limited Company

- L.L.C.

- L.C.

- LLC

- LC

Certain terms, such as “association,” “corporation,” and “incorporated,” cannot be used in the name of an LLC because they would confuse the public regarding the form of business entity structure.

If you discover an available name in Arizona’s business entity database, you can reserve it for up to 120 days by submitting a Name Reservation Application (L001.002). This application can be sent by mail, or you can reserve a name online for faster processing.

The cost of an online reservation is $45, and a paper reservation is $10. By reserving the name, you guarantee that it will be available before you have time to file the formation documents for your Arizona LLC.

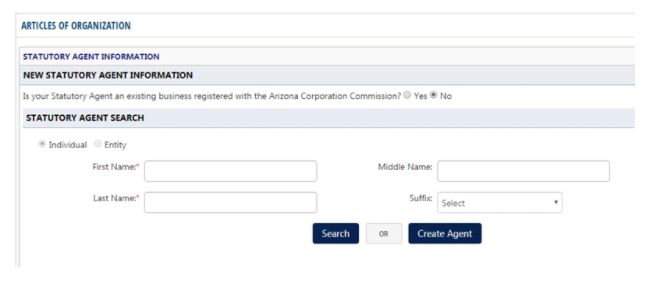

2. Choose a Statutory Agent in Arizona

When you start an LLC in Arizona, you must choose an agent who will approve service of process and official mail on your behalf. The statutory agent, also known as the registered agent in most other states, is a person or business organization with a physical office in Arizona that acts as your LLC’s primary point of contact with the state. The legislative agent would be the first to contact you if your company is sued.

A statutory agent in Arizona may be either an entity or a corporation. An individual statutory agent must be a citizen of Arizona, at least 18 years old, and accessible during regular business hours.

A corporation that is legally permitted to do business in Arizona may also act as the statutory agent. In either case, ensure that your legislative agent has a physical address in Arizona (P.O. boxes are not sufficient).

You or another business owner may act as the registered agent for your Arizona LLC, but your name and address will be made public in the state’s records. Many small business owners choose a commercial provider as their statutory agent for privacy and convenience.

IncFile, an online legal service accredited to offer registered agent services in all 50 states, is one such provider. When you start an LLCs via IncFile, you will receive one year of free registered agent service.

3. Obtain Arizona Business License

A business license may be required by the city or county in which your company operates, but there is no statewide business license. To learn about local licensing standards, contact your city or county office.

However, a few occupations are regulated at the state level. Acupuncturists, chiropractors, barbers, and pharmacists are only a few examples. If you’re not sure if your industry needs a state or local license, consult the list of Arizona regulatory agencies.

The Arizona Department of Revenue issues licenses to companies that sell products or services that are subject to sales tax on a statewide basis. Arizona refers to sales tax as a “transaction privilege tax.” This tax must be collected from your customers and remitted to the state on a quarterly, monthly, or annual basis. The frequency is determined by the amount of tax collected.

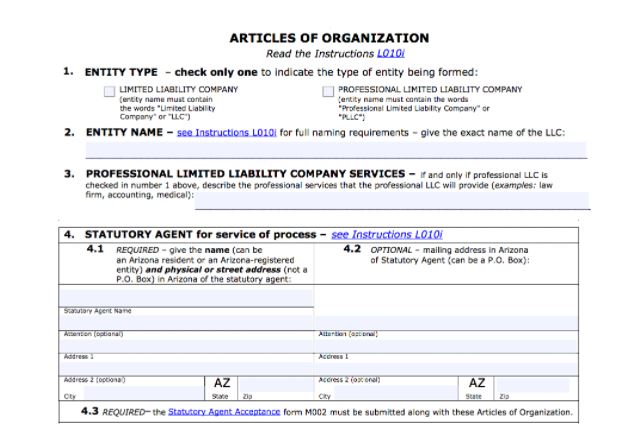

4. File your Articles of Organization

Then, to legally establish your LLC, file your articles of organization (Form L010.003) with the Arizona Corporation Commission. You must also apply a Statutory Agent Acceptance (Form M002) and Cover Sheet with your papers. You may either mail or file these forms online. There is a $50 filing fee.

The following details will be used in the Arizona articles of incorporation:

- The Kind of LLC (regular LLC or PLLC)

- The name of the LLC

- Name and address of the statutory agent (P.O. boxes are insufficient)

- The Arizona address of the LLC

- If the LLC is dissolved on a given date, what is the duration of the LLC?

- If the LLC is run by members or by a manager

- The name and signature of the individual completing the form

The Arizona Corporation Commission will review the articles of incorporation to ensure that all of the information is accurate. If all checks out, they will file the papers, which will then become public information. Regular processing time is six to eight business days, but you can pay a fee to get it expedited.

5. Publish a notice of LLC formation

Arizona needs you to publish a notice of LLC formation within 60 days of filing your articles of incorporation. To do this, you must place an ad in a newspaper as a notice of LLC formation in the county where your LLC’s statutory agent is located for three consecutive publications. If you do not meet this condition, your LLC will be dissolved.

Keep in mind that if your Arizona LLC is in Maricopa or Pima counties, you will not be required to complete this move.

6. Draft an LLC Operating Agreement

An operating agreement sets out the rules for how your LLC will be operated on a regular basis, as well as the privileges and obligations of each member of multi-member LLCs. The state of Arizona does not require LLCs to have an agreement, but it is strongly advised that you do.

The following should be included in your Arizona LLC operating agreement:

- A summary of the goods or services offered by the LLC

- The names and addresses of each member

- If the LLC is handled by a manager, provide the manager’s name and address.

- Contributions to the LLC made by each member

- The benefit share and voting rights of each member in the LLC

- The process for accepting new LLC members

- If necessary, the process for selecting a manager

- The meeting schedule and voting procedures for the LLC

- Dissolution terms and procedures for the LLC

After you draft your Arizona LLC op agreement, you can give all members the opportunity to review and sign it before storing it with other business documents. If you need professional assistance in drafting your operating agreements, a service like IncFile will help.

7. Choose your tax structure

For income tax purposes, the bulk of LLCs is pass-through entities. This means that the LLC would not have to pay income taxes. The LLC’s owners, or founders, will pay Arizona state and federal income taxes on their portion of the LLC’s earnings.

In contrast to some other jurisdictions, Arizona does not require LLCs to file an annual report and does not levy a gross receipts tax or an annual LLC fee.

Members of an LLC, on the other hand, will elect to be taxed as a C-corporation rather than a pass-through body. If you want to have your LLC taxed as a corporation, it will be subject to Arizona’s corporate tax rate and laws, as well as federal corporate tax rates.

If your LLC has workers or more than one owner, or if you wish to be taxed as a corporation, you must apply for an EIN, a federal employer identification number. An EIN can also be used when your LLC applies for a credit card, opens a business bank account, or applies for funding.

8. Comply with Arizona Employer Obligations

In addition to the measures outlined above, Arizona LLC with employees must also comply with the following:

- Employee reporting

Under federal and state law, employers must report new hires to the Arizona New Hire Reporting Program within 20 days of their hire date.

- Employer withholding

Employers in Arizona are required to withhold income taxes from employee salaries and remit withheld payments to the state on a regular basis.

- Paying unemployment taxes

In Arizona, most employers are required to pay unemployment taxes on a portion of their employees’ salaries. New companies will be given a higher unemployment tax rate, which will gradually decrease as the company grows older.

- Obtaining workers compensation insurance

If your Arizona LLC hires even one person, you must receive workers compensation insurance. This includes staff who are representatives or managers of the LLC.

A company attorney who specializes in Arizona employment law will assist you in learning about additional workplace conditions and staying in compliance.

Important steps after forming an Arizona LLC

Keep your personal and business assets apart

When you merge your personal and business accounts, your personal assets (home, vehicle, and other valuables) are at risk if your Arizona LLC is sued. This is known as piercing the corporate veil of business law.

You may begin securing your LLC in Arizona by taking the following steps:

1. Open a business checking account

- This separates your personal assets from the assets of the company and is needed for personal asset security

- It simplifies accounting and tax reporting.

2. Obtaining a corporate credit card

- Aids in the separation of personal and business expenses.

- Builds the company’s credit history, which can be useful for later capital raising (e.g., small business loans).

3. Hiring a business accountant

- Prevents the company from overpaying taxes and assists you in avoiding fees, fines, and other costly tax mistakes.

- It simplifies bookkeeping and payroll, giving you more time to concentrate on your growing business.

- Manages the company’s funding more efficiently, finding places of unanticipated loss or benefit.

Get Business Insurance for Your Arizona LLC

Business insurance allows you to control risks while focusing on increasing your business. The following are the most popular forms of business insurance:

General Liability Insurance: This is a broad insurance policy that protects the company from litigation. The bulk of small companies receive general liability insurance.

Professional Liability Insurance: A form of business insurance for professionals (such as consultants and accountants) that covers allegations of malpractice and other business errors.

Workers’ Compensation Insurance: A form of insurance that covers employees who are sick, injured, or killed on the job.

Workers’ compensation insurance is required by law in Arizona for companies with one or more employees, except officers and LLC members.

Make a Website for Your Company

Creating a website is a significant move toward legitimizing your business. Any company requires a website. Even if you believe your company is too small or in an offline market, if you do not have a website, you are losing out on a significant portion of potential clients and sales.

Some people may believe that building a business website is out of their control because they lack website-building experience. Although this was a legitimate concern in 2015, online technology has made significant advances in recent years, making the lives of small business owners much easier.

The following are the key reasons why you should not put off creating your website:

- Every legal business has a website, period. When it comes to bringing your company online, it doesn’t matter what size or industry it is.

- Social networking accounts, such as Facebook pages or LinkedIn company profiles, are not a substitute for a business website that you own and maintain.

- Website builder software, such as the GoDaddy Website Builder, has made it incredibly easy to create a basic website. You don’t need to employ a web developer or designer to make a website you’re proud of.

Distribute a Press Release

Press releases are one of the simplest and most effective ways to promote your business. They are also one of the least expensive tactics since they:

- Gives publicity

- Establish your brand’s online presence Improve your website’s search engine optimization (SEO), attracting more customers

- Are a one-time investment in terms of time and resources

- Have long-term advantages

Frequently Asked Questions (FAQs)

How long would it take to shape my Arizona LLC?

According to the Arizona Corporation Commission, expedited processing takes about five business days on average, while regular processing can take several weeks.

How much does it cost to start an LLC in Arizona?

Your Arizona LLC Articles of Organization must be filed for a fee of $50. However, if you just pay the regular charge, you can have to wait a month for processing. Expedited delivery costs an additional $35. Next-day service costs $100 more, same-day service costs $200 more, and two-hour service costs $400 more.

Is it appropriate for me to file my Arizona LLC Operating Agreement?

No, you do not need to file the operating agreement for your Arizona LLC. In fact, Arizona does not require LLCs to have this agreement at all. However, drafting one has numerous advantages, such as legitimizing your company, preventing future disagreements, and customizing the LLC’s rules.

What sort of tax structure can I use for my Arizona LLC?

Most entrepreneurs choose pass-through taxation at the state and federal levels, which means that owners pay state and federal taxes on company income, but the LLC does not pay taxes as an agency.

If an LLC has more than one member, the IRS treats it as a partnership for tax purposes, with each partner required to pay his or her fair share. The Agreement of your Arizona LLC allows you to adjust the ownership percentages.

Some LLCs (particularly those with extremely high earnings) can elect to file their taxes as corporations. This choice comes with some distinct tax advantages, which you can read about here. We recommend consulting with a specialist who can clarify the advantages and disadvantages of each tax regime.

Is it legal to form a Series LLC in the state of Arizona?

The Series LLC structure, in which many different LLCs function under one overarching “umbrella” LLC body, is not permitted by the law in the state of Arizona. Individual LLCs (also known as “cells”) can have different members, properties, and responsibilities.

Specific cells and the umbrella LLC, in principle, are shielded from the debts and legal obligations of the others, providing value security for certain small businesses.

How do I pass ownership of an LLC in Arizona?

The procedure for changing limited liability company ownership should be outlined in your operating agreement. In general, each transition should be accompanied by two primary documents. To begin, draft a purchase agreement in which the previous owner sells its LLC interests to the buyer.

Following that, you should revise the Agreement to reflect the shift of ownership (along with any other changes desired by the new collective membership).

How do I delete a member from an LLC in Arizona?

The processes for withdrawing members from your limited liability company, including any voting or cause-related provisions, should be outlined in your operating agreement. Furthermore, you must follow the protocols outlined in your agreement on how the withdrawn member’s share will be allocated among the remaining members or offered for sale to third parties.

Finally, you can update the limited liability company’s operating agreement to reflect the change in membership of the LLC.

Is a business plan needed for my Arizona LLC?

A business plan is not required to file with the Arizona Corporation Commission or legally form an limited liability company. However, writing a business plan can make it easier to find investors or lenders willing to help you get your business off the ground.

A business plan details the structure, priorities, and expectations for your new limited liability company. A successful business plan would also provide details about the company’s founders, market analysis, and possible funding sources.

How do I find customers for my Arizona LLC?

After you’ve registered your limited liability company with the Arizona Corporation Commission, obtained the requisite business licenses, and obtained your EIN, you’ll want to start selling your products or services. Before reaching out to potential clients, aim to understand as much as you can about them.

You’ll be able to build goods and services that they’ll want to purchase if you consider their interests, dislikes, hopes, and fears. Don’t be afraid to try new ideas while designing your offerings and marketing materials to see what works best.

It’s difficult to predict what your customers would want, so keep experimenting until you find what works for you.

What Is The Differences Between a Domestic Arizona LLC and A Foreign LLC?

Limited liability company LLC is referred to as a “domestic LLC” when it conducts business in the state where it was formed. For instance, a domestically formed business Arizona is a form of LLC. Meanwhile, a foreign limited liability company LLC is commonly formed when an existing LLC looking forward to form an LLC elsewhere in another state which requires business licenses and permits.

Conclusion

Starting a new business can be very exciting, but before you can concentrate on the day-to-day operations of your company, you must first choose a business structure. An LLC can be a good option for small companies because it offers liability insurance as well as tax advantages. It is also relatively simple to shape and maintain an LLC in Arizona if you follow the steps outlined above.

Starting a business correctly doesn’t have to be difficult. With over 15 years of experience consulting new businesses and start ups, Matthew is probably the best person to help you set a strong foundation for your business.