What Is an LLC?

LLC stands for Limited Liability Company, it is the legal method to structure a business. Forming an LLC is perfect for business owners that do not want to be held liable for the company’s debt or liabilities. An LLC has the characteristics of a partnership or sole proprietorship corporation.

Regulations for LLCs (Limited Liability Companies) can vary from state to state and there are some steps that you need to follow to start an LLC in Delaware.

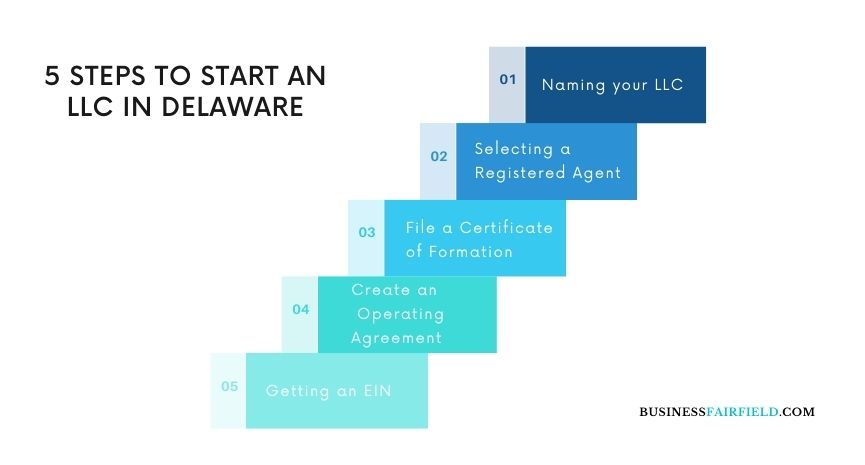

How To Set Up An LLC In Delaware?

Here are 5 steps that you, as a business owner will need to know when starting an LLC in Delaware:

- Choose a name for your Delaware LLC

- Pick a Delaware Registered Agent

- File a Certificate of Formation

- Create an LLC operating agreement

- Secure a Delaware LLC EIN

1. Choosing a Name For Your Delaware LLC

Having a company name is the first and most important step to form your LLC in Delaware. You need to make sure that the name of your LLC is compliant with the naming requirements in the state of Delaware.

According to the Delaware law, the naming of Delaware LLCs must include “Limited Liability Company” or any of its abbreviations, “LLC” or “L.L.C.” In addition, there are also several names that are not allowed to be included in the name of your LLC such as “Corporation”, “Incorporated” or the abbreviations like “Corp.” and “Inc.”. There are also certain names that will be rejected by the Delaware Division of Corporations that do not meet the requirements.

The name of your Delaware business should also be distinguishable from any other limited liability company, corporation, partnership or limited partnership in Delaware. What it means is that when naming your LLC, you should check to see if there are any businesses in Delaware that have the same name. If the name that you picked is unique, you may use it for your LLC.

You may search for the availability of names through the Department of State: Division of Corporations business name database. If the name that you want is available, you may also make a reservation online on the Delaware Division of Corporations website. However, the name can only be reserved for 120 days and a fee of $75 has to be paid.

On a side note, it is also recommended for you to check online if the business name is available as a web domain. You may not plan on creating a website now but it is suggested to acquire the URL before others get it.

2. Appointing a Registered Agent in Delaware

To form a Delaware LLC, you are required to nominate a Registered Agent in Delaware. A Registered Agent is usually a person or a business entity that handles the legal paperwork of your LLC in case your business gets involved in any lawsuits.

You may also be a Registered Agent for your LLC as long as you have a street address that is located in Delaware. However, if you require a more professional service, you may hire a Delaware Registered Agent Service, also known as Delaware Commercial Registered Agent.

Hiring a professional Registered Agent Service gives you more time to focus on your business and also the peace of mind. But bear in mind, these Registered Agent Services can cost you between $100 to $300 annually.

Other than hiring a Registered Agent Service, if your LLC is physically located in Delaware, it can act as its own Registered Agent because a Registered Agent can be a business entity as well. Lastly, there is also a list of Registered Agents that is available on the website of the Delaware Secretary of State.

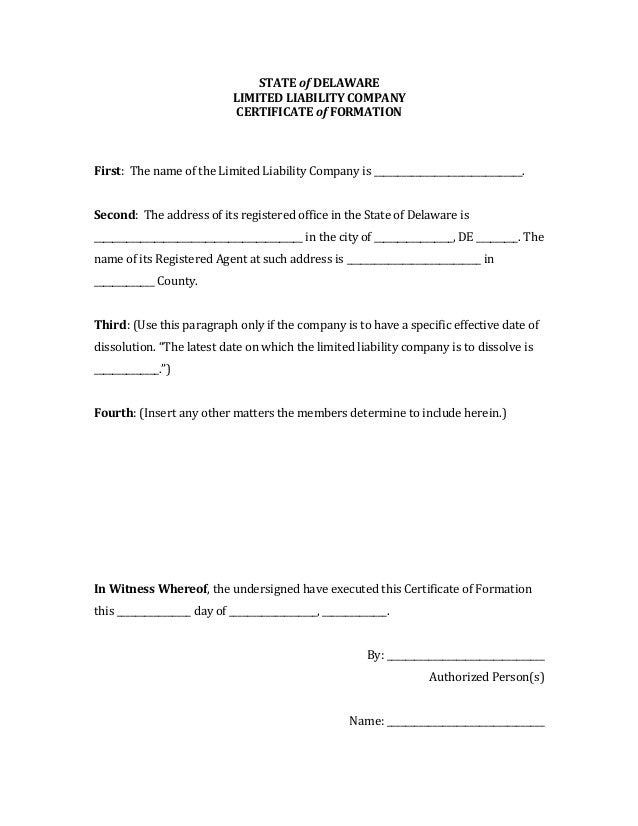

3. Filing a Delaware LLC Certificate of Formation

In order to officially form your Delaware Limited Liability Company, you will need to file a Certificate of Formation with the Delaware Division of Corporations. The Certificate of Formation, or in some states known as the Articles of Organization or Certificate of Organization can be filed by mail, fax or in-person.

The Certificate of Formation is a legal document that is required to form your Delaware LLC and the Certificate of Formation must include the following:

- The name of your Delaware LLC

- The name and address of the Registered Agent of your Delaware LLC

- An authorized person’s signature

After that, you will have to pay the state filing fee of $90 to the Delaware Department of State and wait for the approval. You should take note that this LLC filing fee is the same thing as a fee for the Certificate of Formation. Once the document has been approved by the Division of Corporations, your Delaware LLC formation will be completed.

If you already have an LLC that is from another state and is looking to expand into the State of Delaware, you will need to form a Foreign LLC instead of a Certificate of Formation.

Forming a Foreign LLC will enable your business to operate as a single business entity across multiple states. However, you will have to pay a filing fee of $200 to the Secretary of State and mail the Foreign LLC form to the Division of Corporations.

4. Creating a Delaware LLC Operating Agreement

Unlike the Delaware LLC formation documents, the Operating Agreement is considered as an “internal document” and does not need to be mailed into the Division of Corporations or pay any state filing fees to the Delaware Secretary of State.

An Operating Agreement of an LLC is a legal document that involves all the LLC members and states how the LLC should be operating. The purpose of Operating Agreements is to clearly indicate who are the members and what percentage of the LLC will they own. In any case, where an Operating Agreement is absent, the state LLC law will determine how your LLC operates.

Even though an Operating Agreement is not required, it is still important to have one for your LLC. A good Operating Agreement will indicate all the necessary details and keep the business owners of your LLC on the same page, reducing the risk of conflict in the future.

Do note that creating an LLC Operating Agreement is not compulsory in Delaware, but it is good practice to have one for your LLC.

Whether you are starting an LLC with a single member, you, or a multi-member LLC, having a Delaware LLC Operating Agreement is still recommended. It is usually multi-member LLCs that have a conflict due to unclear terms in Operating Agreements, so if you are starting a business with somebody else, it is best to state the terms clearly in the Operating Agreement.

5. Securing a Delaware LLC EIN

EIN is short for Employer Identification Number, also known as FEIN (Federal Employer Identification Number) or FTIN (Federal Tax Identification Number) and it is a number assigned by the IRS (Internal Revenue Service) to your Delaware LLC.

The purpose of an EIN is to help the IRS identify your business for taxing and filing purposes. Think of EIN as a Social Security number for a business.

Getting an EIN allows you to open a bank account under the name of your business which is separated from you. It also allows your LLC to hire employees and handle their payroll. Application of licenses and permits can also be done if your LLC has an EIN.

If you had a sole proprietorship business that is converting to an LLC, you should get a new EIN. Getting an EIN from the IRS for your Delaware LLC can be done easily through an online application or by mail. No filing fee is required for the application of an EIN for your business in Delaware.

One thing that you should take note when applying for an EIN for your business, wait for your Delaware LLC to be approved before applying. If in case the filing of your LLC has been rejected, the EIN that you have applied for will be associated with an LLC that does not exist.

However, you can cancel the EIN and apply for a new one but you would have to wait for the cancellation before you can apply for a new EIN.

Important Things To Keep In Mind After Setting Up Delaware LLC

At this point, you would have completed the steps to form an LLC in Delaware. However, there are still some things that you should be aware of after forming an LLC. These things will make sure that your Delaware business stays on the right track.

Paying the Annual Franchise Tax

Unlike Corporations in Delaware that need to file Annual Reports, Delaware LLCs are not required to file an Annual Report or pay the fees to file Annual Reports. However, it is compulsory for Delaware LLCs to pay an Annual Franchise Tax of $300 every year.

After the formation of every LLC in Delaware, the $300 tax has to be paid no matter if your business in Delaware is active or not. It is a requirement by the state to keep your LLC compliant.

The Annual Franchise Tax is due on June 1st annually and the payment can be done online only using a credit card or checking account. An example would be, if your LLC was approved on April 20th, 2019, the tax will be due by June 1st, 2020, instead of June 1st, 2019.

If this tax is not paid by June 1st, there will be a penalty of $200 and a 1.5% interest for every month that the tax is not paid. Which is why it is a good habit to set a reminder to pay the tax annually. The state will also be reminding your Registered Agent in February annually and your Registered Agent can give you a heads up to pay the tax.

Break Up Your Personal and Business Assets

Business accounts and personal ones should always be separated because if they are not separated and in any case where your LLC in Delaware is sued, your personal assets will also be at risk. This is also known as piercing the corporate veil.

To protect your business in Delaware and your assets, you can start by opening a bank account for your LLC. When you open a business checking account, it separates your own assets from the business’ assets and also makes it easier for accounting and tax filing.

Another thing to do is to get a credit card for your business. This helps you to separate your personal expenses from the expenses of your business. It can also build a good credit history for your LLC and can be of great use when you want to raise capital by applying for business loans in the near future.

Getting a Business License and Permit for Your Delaware LLC

After the approval of your LLC, you are required to comply with the business license and permit requirements of the state. The requirements can be different depending on the state that you operate your business in and the requirements also depend on the industry that your business is involved in.

If you do not comply with the business license and permit requirements, your business can be subjected to penalties and fines. Worst case scenario is that you will be restricted from conducting business in the state. So make sure to check for the type of licenses and permits that your business in Delaware may need.

To find out what licenses and permits are required for your business, you may hire a professional service to get it for you or you can do it on your own. Fees will also vary depending on the license and permit that you are getting.

Finding a Business Accountant

After you form an LLC in Delaware, you should look for an accountant to help with your small business accounting. The business structure of an LLC has many benefits and one of them is the ability to write off business expenses and enjoy the benefits of pass-through taxation. With an accountant, you can take advantage of the benefits and can save your business a significant amount of money every year.

The accountant that helps with your small business accounting can also assist you to track your business expenses, identify profit and loss in your business, submit tax filings and other financial hassles of running a business.

Meeting the Delaware LLC Tax Filing Requirements

The type of tax and the amount to be paid can vary depending on the type of your business and you may have to pay for more than one type of tax in Delaware.

Annual Franchise Tax

As mentioned earlier, this is a tax that all Delaware LLCs will have to pay. If you form an LLC in Delaware, you will be subjected to pay $300 annually to keep your LLC in compliance.

Delaware Sales Tax

There is no sales tax imposed in the state of Delaware which means that goods and services will not be taxed. However, some businesses will have to pay the Gross Receipts Tax.

Delaware Gross Receipts Tax

This tax is imposed on most of the businesses in Delaware and is taxed based on the revenue received from the sale of goods and services. The percentage can vary from 0.1037% to 2.0736%, depending on the type of your business.

State Income Tax

If your LLC is a multi-member LLC, the state of Delaware will require you to file for a state income tax with the Department of Revenue. No filing fee is required for the filing of state income tax.

Avoid Automatic Dissolution

After you form an LLC in Delaware, you have the privilege of limited liability protection. However, if you do happen to miss one or more state filings, your limited liability company will face penalties and the possibility of automatic dissolution which will lead to you losing the limited liability protection.

Getting a Business Insurance

Just like getting insurance for yourself, your limited liability company should be insured as well. Getting business insurance can help to manage your risks and allows you to focus on growing your business. There are also different types of business insurance that you can get:

- General Liability Insurance

- Professional Liability Insurance

- Workers’ Compensation Insurance

Obtaining a Certificate of Good Standing in Delaware

The Certificate of Good Standing is also known as a Certificate of Status. It is a verification that your Delaware LLC was legally formed. Here are a few reasons that you might need to get this certificate for your LLC:

- Getting funds from banks or other lenders

- When you form your business as a foreign LLC in other states

- Securing or renewing business licenses or permits

Dissolving an LLC in Delaware

This section is not about getting you ready to start your LLC but instead, will cover some basic guidelines if in the near future you decide to shut down your business. A proper term to describe the closing of your business is dissolving it and it is important to dissolve it if you no longer want to continue it because it can lead to liabilities or even legal issues.

There are detailed guidances available to dissolve your LLC but the two basic steps to take is to close your LLC tax accounts and file the Delaware Articles of Dissolution.

Summary

By following the first 3 of the 5 steps, naming, finding a Registered Agent and filing a Certificate of Formation, you would have started your LLC in Delaware.

The steps after the first 3 are essential after the formation of your LLC to make sure that it is compliant with the relevant laws. After that, by considering the things after forming an LLC, you will be able to successfully keep your limited liability company LLC compliant and run it as you would.

Frequently Asked Questions (FAQs)

How much does it cost to form an LLC in Delaware?

To be ready to start an LLC in Delaware, you will need to prepare $90 for the filing fee and $75 to reserve a name. The fees that were stated are only applicable if you are filing it on your own and it can be complicated to do it yourself. Hiring someone else to do it for you will make things easier but it will also cost you more money but as an easy guide, $165 is enough for an LLC to be formed in Delaware.

Can I form a professional LLC in Delaware?

Yes, you can form a professional limited liability company LLC in Delaware. If you are required to get a Delaware state license before you can practice, the services you provide can be considered as professional. An example of a professional service is dentists because you will require to obtain a license before practising.

Do I need to get a DBA or Trade Name for my LLC?

Not necessarily. LLCs do not need to register a DBA because the name can serve as a brand name but you can register a DBA if you want to conduct business with a different name.

How long does it take to form a Delaware LLC?

The approval time of the Certificate of Formation is 1 week and can take up to 3 weeks depending on how busy the state is but the approval can be expedited within 24 hours with an extra payment of $50.

What kind of tax structure is suitable for my Delaware LLC?

The kind of tax structure that you opt for depends on the nature of your business but generally, after you get an EIN, you can choose from several different tax classifications and most LLCs opt for the default tax status.

How to Dissolve an LLC in Delaware?

If you’re looking to shut down operation and dissolve your business entity, you must formally dissolve the business structure. The failure to properly dissolve within the time-frame would result in potential legal implications, penalties and tax liabilities. The methods into dissolving your business entity could be carried via closing your business tax accounts or through filling the Delaware Articles of Dissolution.

Starting a business correctly doesn’t have to be difficult. With over 15 years of experience consulting new businesses and start ups, Matthew is probably the best person to help you set a strong foundation for your business.