New York acknowledges a wide variety of business models, including Limited Liability Company (LLC), limited partnership, sole-owner business, general association and other less-known forms. Each of them has its own benefits and inconveniences.

The business type of preference is decided for any given undertaking, personal and business circumstances. In the absence of guidance on the type of business method, the Department of State highly advises working with legal and financial experts prior to making a choice.

LLC formation can only be carried out after detailed analysis. To answer your questions about the creation of LLC and to facilitate the presentation of the articles of organization, we have established the following material.

The Department of State division registered agent cannot offer legal counsel but is willing to help address concerns about the filing of LLC papers.

LLC Specifications in New York

What is a Limited Liability company?

An LLC is a business corporation with one or more individuals limitedly responsible for the business’s contractual commitments and other liabilities. The limited liability statute regulates the creation and operation of an LLC.

An LLC can organise for some legitimate business reason. The LLC is a hybrid model incorporating the limited liability of corporate form with the versatility of relationship type. With its versatile management system, owners will form the LLC to fit business needs.

LLC investors are not founders or investors but are “members.” A member may be an individual, a corporation, a business, a limited liability company or a legal body. To form an LLC, there is also a state fee included in most LLC formation companies.

Do be advised that there is a term called ‘registered agent service’, where there are people available to help with any questions you have, be it business structure, or business taxes and state taxes, or even business formation.

Department of State in New York

The Department of State was established in 1778 and is the oldest in New York’s government. Cuomo has re-imagined the Department of State as a vehicle to provide service to reinvigorate the State’s economy and make our communities more livable.

The Department of State makes strategic investments to revitalize communities and spur economic growth, Cuomo says. The Department of State also provides financial and expert technical service to local governments to improve services and become more efficient, he says.

In 2012, the Department of State created the New York State Office for New Americans, which provides service to immigrants fully participating in the. State’s civic and economic life. The Department of State protects the interest of the state of New York consumers.

The Department of State also resolves thousands of consumer complaints through voluntary mediation between the public and businesses. The Department Of State defends the interest of the state of New York customers from general education in marketplace scams and customer advocacy in the eyes of legislative and regulatory bodies.

The Department of State also addresses thousands of customer grievances by informal public-business mediation. Recently, at the behest of Governor Cuomo, the Department of State has created the Empire State Fellows Program, a full-time leadership programme that trains young professionals from the next generation for careers as policymakers in New York City.

Articles of Organization

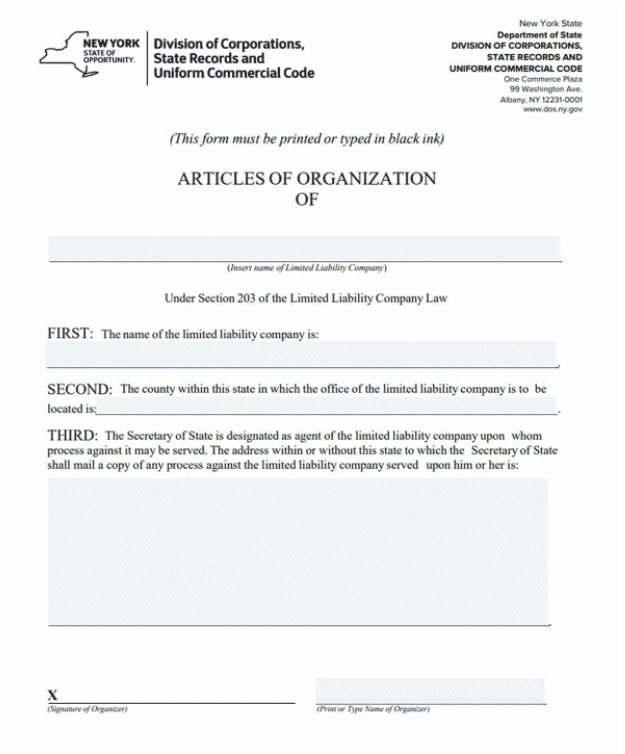

The articles of organization are a paper identical to the copy of the articles of incorporation that details step 1 of claims necessary to constitute a limited liability company (LLC) in many U.S. states. In certain nations, articles of organization are referred to as an association certificate, or as a certificate of training.

After the secretary of state or other registrar has filed and approved them, the articles of organization legally create the LLC as an enterprise registered in the state. The articles of organization, along with the operating agreement and company laws of the state where the articles of organization are filed, define LLC governance.

The articles of organization document generally contain the name of the LLC, the form of legal entity (e.g. limited liability company, LLC series), the registered agent, whether the LLC is managed by the founders or directors, the actual date, the period (perpetually by default in most countries) and the name and signature of the organiser.

The Articles of organization set down the powers, privileges, obligations, responsibilities and other substantial duties of LLC members. This paper also lays out LLC members’ commitments.

Your NY Articles of Organization are a body of content that is to be generated in New York by your LLC. A Limited Liability Corporation (LLC) is better described as a corporate organization, a partnership and a company.

The aim of an LLC is to prohibit any legal proceedings against your business from securing your personal properties. After all the papers have been accepted, your LLC is produced and authorised to do business to become a registered agent.

You must ensure that your preferred LLC name is eligible for use before your business can be started up.

It is necessary to determine which address you will join in your training papers and the area in which your newspaper advertisements are distributed, which will warn the public of the creation of an LLC.

How do I start an LLC in New York?

In compliance with Article 203 of the Law on Limited Liability Companies, the organisers create an LLC by applying to the Department of State the Articles of Association. Organizers are planning, signing and filing the organizational papers forming the New York LLC.

An organiser can be any individual or organization. Organizers may be a part of the New York LLC, but do not need to be.

How much does it cost to set up an LLC in New York?

You will be requested in the New York Department of State Division to file the Articles of Association for $200.00 to form a New York LLC. You may submit your application to the Department of State via online or by mail. The Association Papers is the legal document formalising the New York Limited Liability Corporation.

How long does it take to form an LLC in NY?

The preparation requirements for New York LLC, including form processing in New York, typically take six to seven weeks to satisfy. With respect to publishing schedules, companies are permitted for six consecutive weeks until all New York LLC transactions are halted, up to 120 days from the date of filing the articles of their business in two newspapers.

How are LLCs taxed in New York?

Federal tax laws allow a New York LLC to opt to be taxed for income tax purposes as a corporation or as a partnership. Consult a tax advisor to make some amendments to these laws. State law is in compliance with federal law for income tax purposes. State law also imposes a levy on the number of New York LLC members.

In addition, New York LLC will have to pay or collect income taxes, withholding taxes and other taxes, depending on the type of the enterprise that it undertakes. A taxpayer ID number from the Internal Revenue Service is required. LLC is required. The IRS will answer questions about income taxation, social security and other federal taxes, or about paying or keeping them.

“All Rights Reserved”

“All rights reserved” is a copyright requirement implying that the copyright holder retains, or holds for his own purposes, all rights under copyright law. Originating in the 1910 Buenos Aires Convention, it is not clear whether the “all rights reserved” copyright has any legal impact in any jurisdiction. However, many trademark holders do use the “all rights reserved” copyright.

How to start an LLC in New York NY?

1. Choose a Name for your LLC

Step 1 is choosing a name for your LLC. Step 1 is very important. In New York, the name of your LLC must be “Limited Liability business” or “L.L.C.” It is important to differentiate the LLC’s name from the names of other corporations currently filed with the New York Secretary of State.

Names in the corporate name database can be tested for availability in the New York State Division of Corporations. Through sending a Name Reservation application to the New York Department of State Division of Businesses, you may assign a name for sixty days.

The request must be made by post. The fee is 20 dollars. When you do business in the real world, you don’t need to use the official name of your LLC registered in your Articles of Association.

Instead, a given name may be used and is often known as a fictional business name, “DBA,” or trade name. You must register the assumed name with the Department of State of New York for that in New York. By sending a certificate of assumed identity you enrol by postal mail. The registration fee is 25 dollars.

2. Submit an address to which legal records can be sent

Every LLC’s “registered agent for service of process.” is automatically made up of the New York Department of the State. If the LLC’s legal records are prosecuted, the Department of State will recognise them for the sake of the LLC and forward the documents to the LLC.

You must have a name and an address to the Department of State for which proceedings (calls and grievances for proceedings referred to as “process”) and for transmission of such legal documents.

An additional registered agent for processing may also be assigned to a New York resident, or to a licenced commercial registered agent.

3. File Articles of Organization

A New York LLC is formed by the New York Department of State Companies filling in the Articles of Association. The papers shall contain:

- Name of the LLC

- The New York county where it’s going to be

- The Secretary of State can mail the LLC legal documentation to the New York address

- The organiser of the LLC, and

- Articles filer’s name and address.

The things can be submitted by post or online. The fee is 200 bucks. Follow the instructions given to complete your papers and send them.

4. Prepare an Operating Agreement

Unlike in other jurisdictions, a written operating agreement is required for LLC members under New York’s LLC Statute. The operating agreement could be reached before, after or after 90 days of the submission of the Articles.

The operating agreement is the principal contract setting out the assets, powers, responsibilities, liabilities and obligations of the members of the LLC.

It is strictly an internal paper and it is not forwarded to the Department of State. New York regulation silences the implications of failing to follow an operating agreement.

5. Publication Requirements

The LLC shall publish two newspapers with a copy or a correspondence affecting the creation of the LLC within 120 days of its articles being written. The papers shall be named in the Articles of Association by the county office of the county in which the office of the LLC is located.

Upon printing, you may receive a publication affidavit from the printer or publisher of each newspaper. A publishing certificate must be presented to the New York Department of State, Division of Companies, with affidavits attached on the publication of the newspapers.

The fee to request the publishing certificate is $50.

6. Comply with other conditions for tax and regulatory

For your LLC, additional tax and regulatory conditions will apply. This may include:

Employer Identification Number (EIN): If the LLC has more than one member, even if it has no registered agent, it must receive its own IRS Employer Identification Number (EIN). If you form a one-member LLC, you must only receive a new york LLC Employer Identification Number (EIN) for it if it has personnel or if you wish to make it taxed as a business instead of a sole proprietorship (disregarded entity).

By completing an online Employer Identification Number (EIN) application on the IRS website, you can obtain an Employer Identification Number (EIN number). No filing fee applies to the Employer Identification Number.

Business Licenses: The state of New York may require you to either acquire a licence or a permit, depending on the type of your business. See the state’s New York Business Express website for more information.

You will also require the municipality’s local business licence. Contact the county clerk and the clerk of the city, state, or village in which the LLC business will work for details on local licences.

Annual State Filing Fee: Any domestic or international LLC that is treated for federal income tax purposes as a partnership or disregarded business having any income, benefit, expense, or deduction originating from New York sources is subject to an annual filing fee.

An LLC that elects to be considered for federal income tax purposes as a business is not entitled to the filing fee. Using Form IT-204-LL, Corporation, Limited Liability Corporation, and Limited Liability Partnership Filing Fee Payment Form, the fee is charged to the Taxes and Finance Department of State (often also called the Tax Department of State) (available on the New York State Department of State in Taxation and Finance website).

Depending on the LLC’s revenue, the fee ranges from $25 to $4,500.

Frequently Asked Questions (FAQs)

Should I form an LLC?

You should consider forming an LLC whether you are only beginning your business or have already been working as a sole proprietor. LLCs restrict the legal responsibility of an individual for corporate debts and claims and have a lot of freedom as it comes to corporation control, management, and taxes.

How am I supposed to know if my LLC name is available?

It is necessary to ensure that the name of your LLC is distinguishable from the names of other established companies on file with the State Division of Corporations Department of State in New York.

To ensure that your proposed name is accessible, you can perform a name search for free on the New York Department of State website.

Do I need an operating agreement for my LLC in New York?

New York does not mandate LLCs to have operating agreements, but it is extremely beneficial to have one.

An LLC operating agreement can help to secure your limited liability status, avoid financial and managerial misunderstandings, and guarantee that you compromise on the laws regulating your business rather than state law by necessity.

Can international LLCs do business in New York City?

In order to conduct business in New York, all LLCs incorporated outside the State must file with the New York Department of the State of the business. Foreign LLCs must name a licenced process officer who is physically based in New York. To file, apply an Application for Authority to the Companies Division.

Applications may be submitted electronically using New York State-approved software if you may not need a tax practitioner to file and have access to a computer and the Internet; otherwise, they can be filed by mail.

The filing fee is $250 and the paperwork must contain a certificate of life or equivalent record from the home country of the LLC that is not more than one year old.

Can I create a single-member LLC in New York?

For most of the training purposes, a New York single-member LLC is known to be the same as a multi-member LLC. The steps taken to form a single-member LLC in New York are the same as those indicated above.

However, single-member LLCs have more versatility when it comes to filing a tax return.

Can I form a professional LLC in New York?

If you have a licenced professional service in New York and plan to create an LLC, you would be expected to incorporate a professional limited liability corporation (PLLC). Examples of professional services include engineers, judges, dentists, certified public accountants, and more.

Generally, if you have a service that allows you to receive a New York state licence before you practise, then you are a professional service. In order to join a PLLC, each member of the corporation must be approved.

How am I going to get an EIN if I don’t have a Social Security number?

There is no need for an SSN to get an EIN. You should easily fill out the IRS SS-4 form and leave section 7b blank. Please contact the IRS at (267) 941-1099 to complete your submission.

What kind of tax system do I select for my New York LLC?

When you get an EIN, you will be told of the various tax classification choices available. Most LLCs elect the default tax status.

However, some LLCs can minimise their federal tax obligations by electing S Corporation (S Corp) status. We recommend contacting your local accountant to figure out which choice is better for you.

Do I need an EIN to get my LLC?

Any LLCs with staff, or any LLCs with more than one member, shall have an EIN. This is expected of the IRS.

How to Obtain a Certificate of Publication in New York?

A Certificate of Publication, known as a Certificate of Status in New York, verifies that the LLC has been legitimately established and has been adequately managed. Several occasions where you can need to get one include:

- Financing by banks or other lenders

- Forming your business as an international LLC in another country

- Obtaining or renewing special business licences or permits

- You may request a New York LLC status certificate by mail.

The Certificate of Publication is expected to be filed within 120 days of submission of the DOS-1336 form to the Department of State.

What is the minimum wage in New York?

New York State’s $11.80 minimum wage an hour. The minimum wage is 15.00 dollars per hour in New York City. The minimum wage is $13.00 an hour for the counties of Westchester, Nassau, and Suffolk.

When I’m done, how do I dissolve my LLC as a business owner?

When you hit the point that it is time to shut your business and suspend all activities, you may want to dissolve your limited liability company properly in order to reduce your liabilities for claims and government fines. The right steps are as follows:

- Meet Dissolution Laws. These should be mentioned in the operating agreement of your limited liability company.

- Wind up the LLC.

- Notify the persons involved.

- Address any claims

- File taxes.

- File dissolution papers.

- Wrap up a separate tax corporation.

- Finish out-of-state approvals.

Can I be my own registered agent in New York?

Yes, the business owners or anyone else in your limited liability company can serve as the registered agent for your New York LLC.

Is a registered agent service good?

Yes, engaging registered agent services is an cost-effective and time-saving method in managing your government filings for your limited liability company in New York.

Important Steps After Registering a LLC in New York

Separate your personal assets and your corporate assets

If your personal and corporate accounts are combined, your personal properties (home, vehicle, and other valuables) are at risk in the event that your New York LLC is being sued. In business law, it’s also referred to as “piercing your corporate veil”.

With these two steps, you can secure your LLC in New York:

Opening a bank account for business:

- Separates your personal assets from the assets of the organization that are required for the security of your personal assets.

- Easier payroll and tax reporting.

Get a corporate credit card:

- Helps you to differentiate your personal and business expenses.

- Create the business’s credit history, which can be helpful in raising money (e.g. small business loans) later on.

Find a Business Accountant

All of the key factors LLC’s outstanding corporate structures are the advantages of going through taxes and the opportunity to pay off business expenses.

Getting a business-savvy accountant to support you with your small business finances and taking advantage of these incentives will literally save you and your business thousands of dollars in taxes per year.

- Along with the apparent advantage of substantial tax cuts, a business accountant will help:

- Track business expenses and consolidate bank accounts.

- Discover unexpected sources of failure or extra benefit in your business.

- Managed payrolls for you and your staff.

- Prepare and file quarterly tax filings.

- Advise on advanced market plans for greater tax saving.

Stop expensive mistakes to make sure the business remains on the correct side of the IRS.

Starting a relationship with an accountant gives you a head start when it comes to running your business and keeping your finances tidy in the future.

Get Business Insurance for your LLC

Business insurance lets you control your risks and focuses on increasing your New York limited liability company. The most popular forms of insurance are:

- General Liability Insurance: a flexible insurance scheme that covers the business from litigation. Many small companies are protected by general liability insurance.

- Professional Liability Insurance: commercial insurance for professional service providers (consultants, accountants, etc.) that provides claims for malpractice and other business mistakes.

- Workers’ Compensation Insurance: a form of insurance that offers coverage for workplace disease, disability or death of a registered agent. In New York, firms with one or more contractors, including limited liability company members and corporate officials, are required by statute to have workers’ compensation benefits.

Give a Press Release

Press Releases are one of the simplest and fastest ways to advertise the brand. They are also one of the most cost-effective strategies:

- Ad publication

- Set up your brand identity on the internet

- Enhance SEO on your website, bring more consumers to your website

- Are a one-time effort and money loss

- Have long-term advantages

Avoid Automatic Dissolution

If one or more State filings are unavailable, LLCs can face fines and even automatic dissolution. If so, the owners of LLC fear losing their limited liability. A quality registered officer service can help avoid this consequence by notifying you of imminent filing deadlines and also by sending files for an extra fee on your behalf.

Starting a business correctly doesn’t have to be difficult. With over 15 years of experience consulting new businesses and start ups, Matthew is probably the best person to help you set a strong foundation for your business.