What is an LLC Operating Agreement? An LLC operating agreement is a document which personalises a company’s terms according to its owners’ particular needs. An operating agreement also structures financial and practical decision-making.

An operating agreement is equivalent to business papers that regulate a company’s practises. Although drafting an operating agreement is not a legal duty under most jurisdictions, the creation of a partnership still deems an operating agreement an essential document to be included.

Once the members (owners) have signed an operating agreement, this operating agreement serves as an obligatory set of laws to adhere to. The operating agreement is intended to enable owners to work internally in compliance with their own laws.

If this guide for operating agreement is not included, the business must be managed in compliance with your state’s default rules.

Basics of an Operating Agreement

Each operating agreement is unique to each organisation, but the main elements are as follows:

- Organization, purpose and location of the business

- Capital Contributions

- Distribution of benefit and loss

- Forces of administration and membership, responsibilities and voting rights

- Compensation of the Participant and Manager

- Accounting Accountability

- Shift of Interests

- Dissolution of the business

- Miscellaneous information on participants, administrators or donations

This operating agreement includes any provisions relating to the business, the conduct of its affairs and the privileges and powers of the managing directors, administrators, officers and staff so that they do not interfere with the laws of the State or the Articles of Organization.

How LLC Operating Agreements Work

An LLC is a form of U.S. business which is easy to create and easy to maintain and which effectively reduces the business owners (members) liability. Provided that an LLC is a combination of a partnership and corporation, it offers limited liability for the twin benefit of passing taxes.

You should go a little further to write an operating agreement during the start-up period to take full advantage of obtaining it. This critical paper is often ignored by many because it is not obligatory in many countries. Quite a few countries suggest the need to sign an operating agreement (California, Delaware, Maine, Missouri, and New York).

But be aware, before doing this, this is what you want. This operating agreement is also a document that lays out, according to its founders, the provisions of a limited liability corporation.

It paves the way for the business to pursue and makes operations and management more open. An operating agreement is a contract document of 10 to 20 pages that sets rules and requirements to an LLC.

The use of this document during the incorporation process is compulsory in states such as California, Delaware, Maine, Missouri and New York.

While not all other states rely on including it, writing an operating agreement is always considered smart, because it maintains a company’s status, becomes helpful in the event of misunderstandings and promotes the business under the laws set by you.

Why are operating agreements important?

Since only a few states (California, New York, Missouri, Maine and Delaware) constitutionally compel LLCs to enter into operating agreements, each will benefit from one.

An operating agreement tends to define a variety of essential facets of a business, such as the classification of the legal framework, the creation of rules and procedures and the clarification of the level of supervision and transparency.

An operating agreement allows for the defence of personal responsibility, organisational clarity and settlement of disputes. It is a highly valuable asset to have at your side as your business expands or as membership changes.

Kelly Williams, founder and managing partner of the Slate Law Firm, said that an operating agreement is highly necessary to discern how the LLC is to be handled in the eyes of the state, which is why even one-person LLCs require it.

“Generally, without an operating agreement, the state in which an LLC is filed has default rules that govern it,” Williams said. “However, these states’ default rules are generalised and are not designed to adhere to the individual interests of business owners.

Therefore, an operating agreement is important in order to custom-design the governance of your LLC in the way you see fit.”

When the business earns (or loses) revenue, an LLC agreement will help you make financial decisions, such as the sharing of shareholdings and the redistribution of gains and losses.

Informal and verbal arrangements can get sticky when it comes to finances – these are the specifics that you want formally outlined and decided upon beforehand.

“Each LLC member usually gets a percentage of ownership in the LLC that’s in proportion to their capital contributions, but sometimes partnerships aren’t always so neat,” Ray said. “Operating agreements allow members to divide up ownership any way they see fit.”

An operating agreement which determines how much of the income transferred to the LLC will be dispersed to the members each year.

What if an LLC has no operating agreement?

In some states, you do need an operating agreement. Often this is only necessary if there is more than one member. Particularly if it is not needed by statute, an operating agreement serves three other essential purposes:

- It helps you to regulate your business rather than the rules of your land. In the absence of an operating agreement, state laws (called default rules) regulate a variety of facets of the LLC. In essence, state legislation allows for a standard operating agreement until you build your own. For example, certain state default laws stipulate that members share equally in gains, regardless of the capital investment of each member.

- It covers the element of limited liability of the LLC. In the lack of an operating agreement, the owners (members) of LLC may be entitled to personal responsibility if they happen to be operating on a sole proprietorship or association basis.

- A formal operating agreement makes the specifics of their business arrangements transparent to all stakeholders, eliminating misunderstandings and conflicts.

The default rules set down by the Member States apply to businesses not signing an operating agreement. In that case, it would be of a very general nature that the rules defined by the State are not applicable to any business.

In the absence of an operating agreement, for example, certain countries can stipulate that each partner’s capital contributions are distributed evenly, including all income in an LLC, irrespective of the capital investment from each side.

If an operating agreement continues to act as sole proprietorship or partnership, parties can also be shielded from any personal liability.

Do you need an Operating Agreement or an LLC?

When starting a new LLC, you need an operating agreement to describe its activities. If you already have an LLC set up, you need an operating agreement to provide updates about its activities. In reality and principle, the operating agreement is basically the same as the limited partnership operating agreement which regulates the actions of the limited partners.

You want to make sure to provide all the relevant stuff when writing up the operating agreement.

Is an LLC agreement the same as an operating agreement?

Limited Liability Company members (business owners) agree upon an operating agreement. The Operating Agreement controls the running of the LLC and determines the Members’ rights and responsibilities towards and towards the LLC.

That is the same as a Partnership Agreement. When making an LLC, the LLC operating agreement is not the document you submit.

The LLC operating agreement document is referred to as the Articles of Organization.

How do I write an operating agreement for an LLC?

If you need an operating agreement, certain problems must be discussed. The document’s general format specifies the following:

- Property expressed as a percentage of each member

- The obligations of representatives and voting rights

- A separation of representatives’ roles and forces

- The distribution of profits and losses for members

- The rules regulating meetings and voting

- Problems surrounding the LLC administration

- Purchase and sales arrangements for a member who decides to leave and sell his/her stock (what would also arise should the member die)

The words used in the operating agreement, along with a list of the business purpose, the declaration of its plan to establish, how the new members will be treated, how it selects charged, the length of its time to exist and where it is based, should also be explained.

The status default LLC laws do not suit all, just as “one size doesn’t fit all.” The only way to solve this issue is to enter into it, if you need an operating agreement, that gives your business independence, security and power.

While an Operating Agreement is better to be included in the early phases, you would not be too late to enforce it if you have skipped it, provided that all stakeholders consent.

The document can also be updated with the advice of an attorney at a later stage.

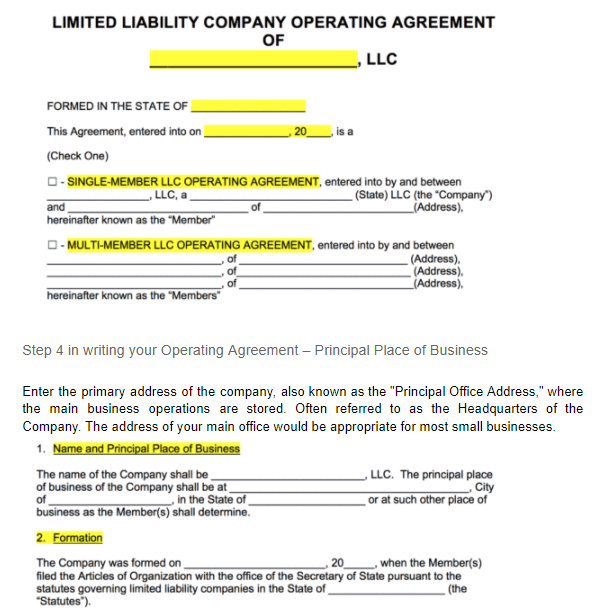

Step 1 in writing your Operating Agreement – Name your LLC

You must perform a check of your preferred name inside the Secretary of State’s office before you name your LLC, usually online. If any LLC assumes your name already, you can then pick a new name since there should be no two organisations in your country that have the same name.

The terms Limited Liability Company or an abbreviation licenced by a State should be issued on your business name, mostly “LLC” (e.g. “John Smith LLC”)

Stage 2 – State of Jurisdiction (Choose Your State)

The state your LLC plans to do business must be reported, not on a federal basis. Application for a tax ID (also known as the federal workplace identification number or “FEIN” and “EIN”) is the only thing registered at the federal level.

Step 3 – Select Type

Single Member – A business with one and only one owner. This document is important, even with only one owner, as it helps to show the status of a third party when asked. If you asked a court to interpret your LLC operating agreement and there were no such operating agreements, it would incorrectly represent your business and you will avoid losing the standing of your company.

Multi-member – A multi-owner business. Both sections of the Operating Agreement are carefully reviewed when they influence the ownership interest and the allocation of all members of the company.

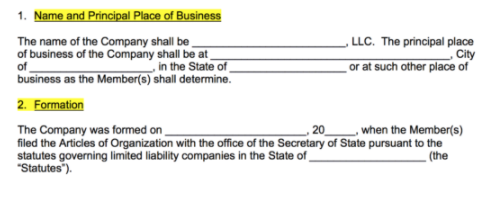

Step 4 – Principal Place of Business

Enter the primary address of the company, also known as the “Principal Office Address,” where the main business operations are stored. Often referred to as the Headquarters of the Company. The address of your main office would be appropriate for most small businesses.

Step 5 – Registered Agent and Office

The Registered Agent shall be a person appointed to receive any and all notifications from outside, including official legal notices, which shall be sent to the registered agent’s address. It is advised that the decision be made to have a lawyer assume the position or a person who is a resident of the state in which the business is based.

Step 6 – Member Capital Contributions

Members who have donated directly to the LLC should have their donations identified. In addition to cash, if any properties (such as cars, office furniture, etc.) are supplied to the Organization, they should be indicated for tax and delivery purposes.

- Distributions – money sent to the members of the LLC created by the sales of the firm. This is generally measured as a benefit or a statistic after covering much of the running costs of the Company. The amount of distribution of which each Member is entitled is generally expressed in the percentage that the Member holds in the LLC. The name(s) of the member(s) and their respective percentage interest should then be entered in the boxes.

- Bank Accounts – The bank account(s) used by the Organization shall have all the money deposited in that account and can only be withdrawn at those periods by the appointed Member(s).

- Management of the Business – The Company can choose to be operated by a member or by a manager appointed by the member (s). If the Organization wishes to have a Boss, it should list their position, power(s) and involvement in the Company.

Step 7 – Member Meetings

Entities are typically expected to meet at least once a year at a venue, usually at the head office of the organisation. This annual meeting may be taken more seriously than others, depending on the organization.

For certain sessions, the minutes must be written listing the items that were addressed along with the votes. All minutes, discussions, votes and any other decisions taken should be recorded and filed.

Step 8 – Assignment of Interests

A clause in which rules on the assignment of ownership in a business can be established. For example, most businesses would encourage shareholders to give their share of the business to other members before they decide to sell stock outside the Company.

Step 9 – Ownership of Company Property (Applies to Single-Member ONLY)

In a Single Member LLC Operating Agreement, you can opt to form the Business as a separate business where all properties are held by the LLC and are not owned by a single member.

Step 10 – Right of First Refusal (Multi-Member Only)

Provides members with the possibility of purchasing interest that is owned by another member before an outside business can make a bid. If any participant declines to purchase the interest at the said price, the outside party will purchase the interest.

Step 11 – Admission of New Members

New members introduced to the business by some form of merger must have the approval of fellow members by a majority vote. The consent of each member should be in writing.

Step 12 – Withdrawal Events (Multi-Member Only)

In the event that a founder dies, the organisation will have 60 days to determine, by way of a referendum, to keep your company operating or to be dismissed. Members are not in a position to leave the Organization in the case of loan default or whether one participant tries to push others out of the LLC.

- Dissolution and Liquidation – Representatives may list different acts that would permit the dissolution of the Company and the sale of all its properties.

- Representation of Members – A provision that specifies that the Corporation is more or less for investment purposes and that extends to both local, state and federal regulations.

Step 13 – LLC Certificates (Optional)

At the choice of the members, they may be able to generate certificates showing their participation in the Group. Only applicable if the LLC chooses to generate it.

- All correspondence rendered to the participants shall be addressed to the address printed in the operating agreement. It is advised that all updates be completed through Certified Mail.

Step 14 – Amendments

If changes or amendments to this operating agreement are to be made, ensure that there are appropriate rules in force such that no one party may make amendments without the consent of the majority of any of the members.

- Compensation – Under single person operating agreements, the section notes that all action taken by the Company shall be without prejudice to any action taken by the Company by the particular business and by any workers or family member. This falls beyond the meaning of the purpose and, if there has been gross neglect on the part of the Members, they can also be found responsible.

- Miscellaneous – The last clause specifies that the operating agreements as a whole is not bound by all of the provisions that do not exist in those jurisdictions and that, if there are certain other terms that may be included in the operating agreements that they are entering into in that region, they are not bound by any of the terms.

Starting a business correctly doesn’t have to be difficult. With over 15 years of experience consulting new businesses and start ups, Matthew is probably the best person to help you set a strong foundation for your business.